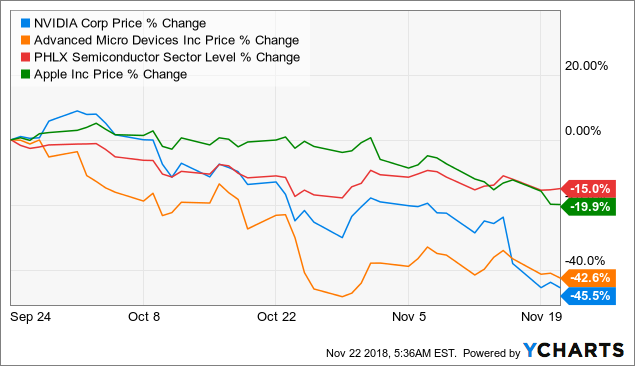

While NVDA has a C rating in our proprietary rating system, one might want to consider looking at its industry peers, United Microelectronics Corp. First, some investors may have been hoping for a more upbeat outlook in spite of the tough comps. How Does NVIDIA (NVDA) Stack Up Against its Peers? I suspect that NVDA's stock is dropping for two primary reasons.

Thus, we think investors should wait until NVDA’s valuations stabilize before investing in the stock. Furthermore, as bearish market trends persist, shares of NVDA might plummet further, given their premium valuation compared to the company’s peers. However, the current weakening demand and Fed’s hawkish stance might limit NVDA’s growth in the near term. Given the robust demand for semiconductors, NVDA is expected to grow substantially over the next few years. NVDA’s robust growth story justifies the Growth grade, while its frothy valuation matches the Value grade.Īmong the 95 stocks in the A-rated Semiconductor & Wireless Chip industry, NVDA is ranked #59.īeyond what I have stated above, click here to view NVDA ratings for Stability, Sentiment, and Quality.Ĭlick here to checkout our Semiconductor Industry Report for 2022 Also, the stock has a B grade for Growth but a D grade for Value. 29 Wall Street analysts that have issued a 1 year NVDA price target, the average NVDA price target is 228.21, with the highest NVDA stock price forecast at 410.00 and the lowest NVDA stock price forecast at 135.00. It is currently trading below its 50-day and 200-day moving averages of $233.60 and $244.25, respectively, indicating a downtrend in sync with the Momentum grade. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree. NVDA has an overall C rating, which translates to Neutral in our proprietary POWR Ratings system. And its forward EV/Sales ratio of 13.80 is 367% higher than the 2.95 industry average. In addition, the stock’s 31.03 forward EV/EBITDA multiple is 154.4% higher than the 12.20 industry average. In addition, the stock is currently trading 14.11 times its forward sales, which is 357.4% higher than the3.09 industry average.Īlso, NVDA’s forward Price/Cash Flow and Price/Book ratios of 40.80 and 12.78, respectively, are significantly higher than the 17.76 and 4.18 industry averages. In terms of forward non-GAAP P/E, NVDA is currently trading at 34.78x, which is 85.9% higher than the 18.71x industry average. Its trailing-12-month total assets rose 100% year-over-year. Nvidia (NASDAQ: NVDA ) may be one of the best-performing stocks over the past decade, but NVDA stock is currently down today after facing a 5.5 million.

Why is nvda stock price dropping today free#

Also, the company’s trailing-12-month EPS and levered free cash flow have improved 122.5% and 73.2%, respectively, year-over-year.

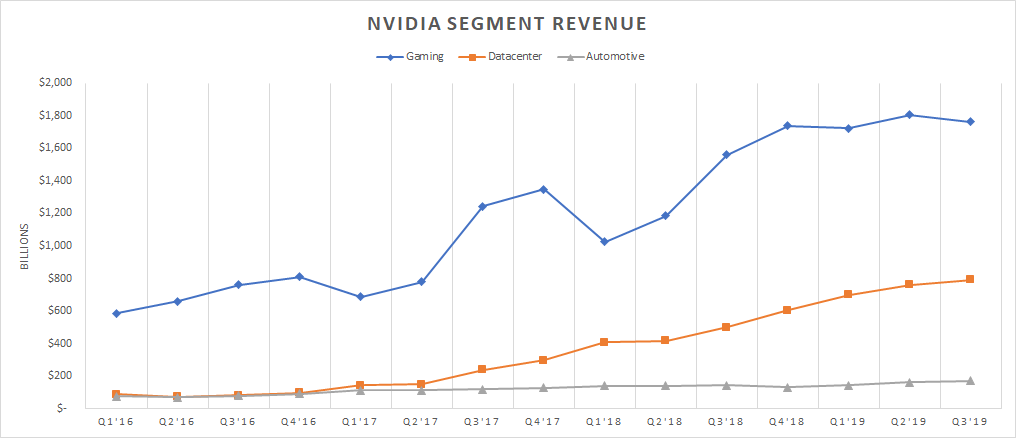

NVDA’s trailing-12-month revenues increased 61.4% year-over-year, while its net income rose 125.1% year-over-year. Its EPS has increased at a 43.1% rate per annum over the past five years. And its EBITDA and net income have risen at CAGRs of 39.5% and 42.4%, respectively, over the past five years. NVDA’s levered free cash flow has improved at a 54.2% CAGR over the past three years. In addition, its EPS has grown at a 32.4% rate per annum over the past three years and at a rate of 43.1% per annum over the past five years. The company’s EBITDA and net income have risen CAGRs of 40.2% and 33%, respectively, over the past three years. NVDA’s revenues have increased at a 32% CAGR over the past three years and at a 31.3% CAGR over the past five years. All Rights Reserved.Here is what could shape NVDA’s performance in the near term: All content of the Dow Jones branded indices © S&P Dow Jones Indices LLC 2019 and/or its affiliates. Standard & Poor's and S&P are registered trademarks of Standard & Poor's Financial Services LLC and Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC. Dow Jones: The Dow Jones branded indices are proprietary to and are calculated, distributed and marketed by DJI Opco, a subsidiary of S&P Dow Jones Indices LLC and have been licensed for use to S&P Opco, LLC and CNN. Chicago Mercantile Association: Certain market data is the property of Chicago Mercantile Exchange Inc. Factset: FactSet Research Systems Inc.2019. Market indices are shown in real time, except for the DJIA, which is delayed by two minutes.

0 kommentar(er)

0 kommentar(er)